Since early August, Ethereum has sustained its lead in spot trading volume over Bitcoin, and the trend continues.

Summary

- Spot Ethereum trading volume has consistently outpaced BTC

- The trend suggests that traders are rotating into altcoins

- Fed’s expected rate cuts fuel bullish altcoin outlook

Bitcoin has long been the undisputed leader in market liquidity. However, as BTC trades near its record highs, investors are slowly rotating into altcoins, and Ethereum is the primary beneficiary. As of September 11, Ethereum is leading in spot trading volume, a trend that has continued since early August. Notably, this is the first time Ethereum has flipped BTC in this metric in seven years.

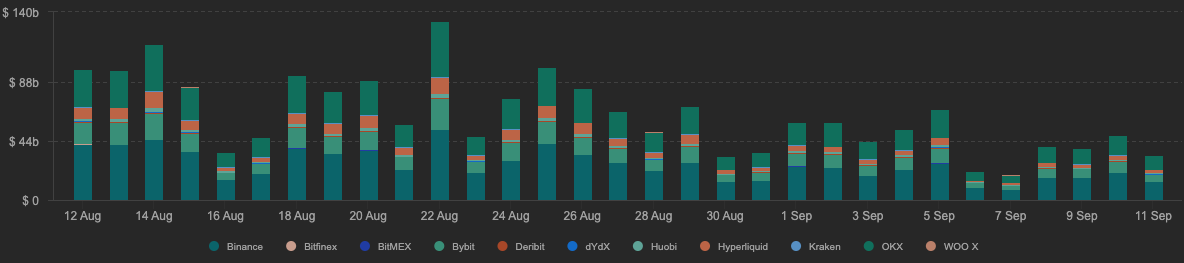

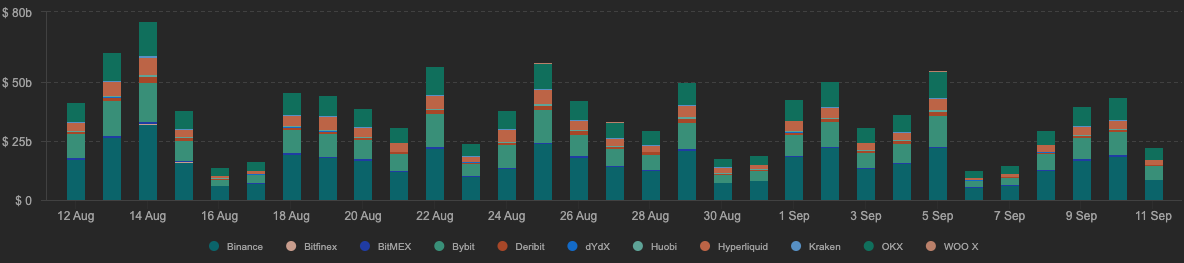

From early August to September 9, Ethereum’s (ETH) trading volume was at 32.9%, according to CryptoRank. At the same time, that figure for Bitcoin (BTC) was 32.6%. What is more, this trend continued, and Ethereum’s spot trading volume reached $48 billion on September 10, compared to $43 billion for BTC.

ETFs show Ethereum and Bitcoin diverging

Ethereum’s rise in spot volume coincided with a divergence of Ethereum and Bitcoin spot ETF flows. Notably, according to VanEck, Ethereum ETFs pulled $4 billion in inflows in August, while Bitcoin ETFs experienced outflows.

The most likely reason for this divergence is growing risk appetite among investors. Bitcoin is near its all-time high levels, while investors anticipate that the Federal Reserve will lower interest rates. In this environment, investors are willing to take riskier bets that potentially offer higher returns.

For this reason, Ethereum traders are testing the $4,400 to $4,500 resistance zone while trading above $4,200. Currently, these are critical levels for the coin. Passing this zone could lead the coin to $5,000, while a collapse below support could lead it below $4,000.