Crypto prices opened the week under pressure, with traders turning cautious about Uptober as top tokens slide from recent highs.

Summary

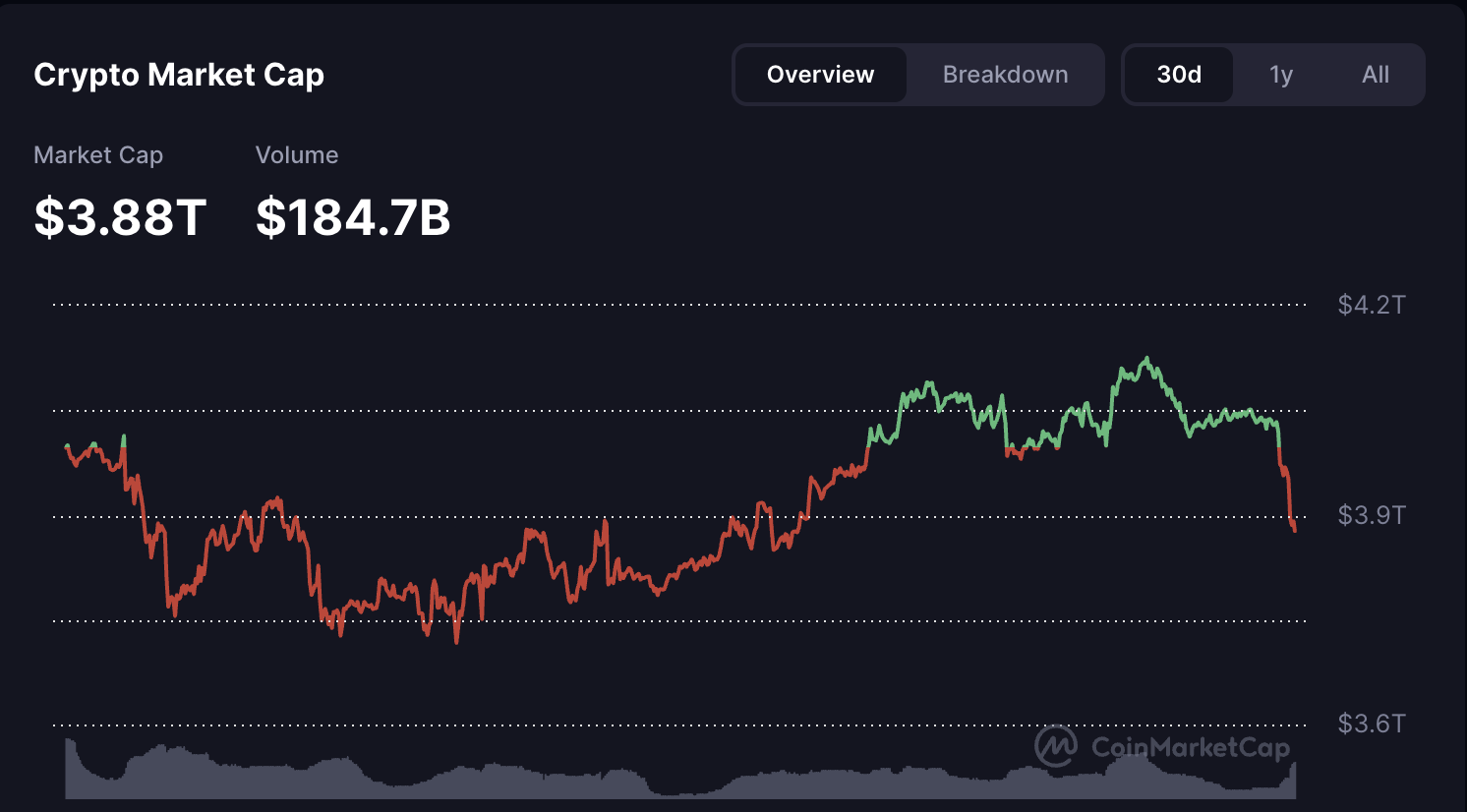

- Crypto prices have dropped 5.6% in the past four days, wiping out $230 billion in market value.

- Bitcoin slipped from $117,000 to $112,000, while Ethereum and Solana fell sharply.

- Profit-taking after recent rallies has added selling pressure across major assets.

- More than $1.7 billion in leveraged positions were liquidated in the past 24 hours.

Uptober is just eight days away, a month when Bitcoin has historically logged strong gains, but traders are turning cautious as recent price action signals weakening momentum. The crypto market cap has fallen nearly 4% over the past 24 hours, shedding about $158 billion according to data from CoinMarketCap.

As the total crypto market cap drops, Bitcoin (BTC) rally has unraveled into a steady retreat. After starting the day above $115,000, the world’s largest cryptocurrency has slipped, dragging as low as $112,000 and leaving it down 2.31% on the day at press time. Other top cryptocurrencies are following a similar slide. Ethereum (ETH) has dropped roughly 6% over the past 24 hours and about 10% over the last week, falling to around $4,200.

Solana (SOL) posted even bigger losses, erasing last week’s gains after climbing from around $230 to above $250. The token is down more than 7% on the day, now trading near $222. Others like XRP (XRP) and (ADA) have also slipped in the broader sell-off, falling about 5% to 6% so far.

Why are crypto prices falling?

Profit-taking, Fed moves, leveraged wipeouts, and bearish signals are undercutting driving the pullback in prices and undercutting Uptober optimism. The ongoing pullback in crypto prices is likely fueled by profit-taking, as investors appear to be locking in gains rather than chasing new highs, especially after recent recoveries in assets. Bitcoin briefly touched $118,000 last week, while Ethereum climbed to $4,600, with altcoins like BNB (BNB) recently breaking above $1,000 for the first time.

This wave of selling into strength has added pressure to the market, opening the door to large liquidations. More than $1.7 billion in leveraged positions were wiped out in the past 24 hours, with long trades on Bitcoin and Ethereum making up most of the losses.

Meanwhile, the much-anticipated Federal Reserve rate cut arrived last week but did little to support crypto. The 25 basis point reduction to 4.00%–4.25% briefly lifted the market, but that uptick was short-lived. Chairman Jerome Powell also emphasized that further cuts were not guaranteed, stressing that policymakers remain data-dependent and focused on taming inflation. That caution cooled sentiment and turned the expected post-cut rally into a broad sell-off.

Market sentiment and technical indicators reflect the shift. The Bitcoin Fear & Greed Index has slid to 45 from 49 just a day earlier, signaling a swift move toward caution among traders.

Looking ahead to ‘Uptober’

Despite the current pullback, October has historically delivered strong returns for Bitcoin and the broader market, thereby earning the nickname “Uptober.” Over the past five years, the month has averaged double-digit percentage gains, a pattern many traders still watch as a potential catalyst for renewed buying.

If macro conditions stabilize and risk appetite improves, capital could re-enter the market. On-chain data shows continued exchange outflows, indicating that long-term holders are moving coins off trading platforms, suggesting underlying conviction remains intact. If buying pressure returns, the seasonal Uptober trend could help crypto prices regain momentum.