The crypto market is surging this week, with Bitcoin and Ethereum nearing their all-time highs and the total market capitalization climbing above $4.2 trillion. This article breaks down the top four drivers behind the rally, including growing expectations that the Federal Reserve will cut interest rates before the end of the year.

Summary

- The crypto market rally is happening as odds of Fed interest rate cuts rise.

- Bitcoin has emerged as a safe-haven asset as the U.S. government shuts down.

- The crypto market normally does well in October and the fourth quarter.

Fed interest rate cuts odds rise

One key reason why the crypto market is going up is the rising possibility that the Federal Reserve will cut interest rates in the final two meetings of the year.

The odds of rate cuts jumped after ADP published a weaker-than-expected jobs report on Wednesday. The U.S. economy lost 36,000 jobs in September. Economists were expecting it to add over 50,000 jobs.

These numbers mean that the Fed may decide to cut rates again to support the economy. Cryptocurrencies and other risky assets do well when the Fed is cutting rates.

Crypto as a safe haven

The crypto market jumped as investors embraced the role of Bitcoin (BTC) as a safe-haven asset as the U.S. government shutdown continues. This also explains why gold price jumped to a record high this year.

In a recent white paper, BlackRock noted that investors believe that Bitcoin has strong fundamentals to thrive as a safe-haven asset when risks rose. The white paper pointed to its fundamentals, including the 21 million supply cap and the rising demand.

One evidence of cryptocurrencies as safe-haven assets is the ongoing ETF inflows. Ethereum (ETH) funds added over $1.3 billion in inflows, while Bitcoin ETFs added $3.2 billion in assets.

Bitcoin, altcoins jump due to the season

Seasonality also contributed to the crypto market rally this week. Crypto investors are talking about Uptober, which is the situation where the industry rallies in October.

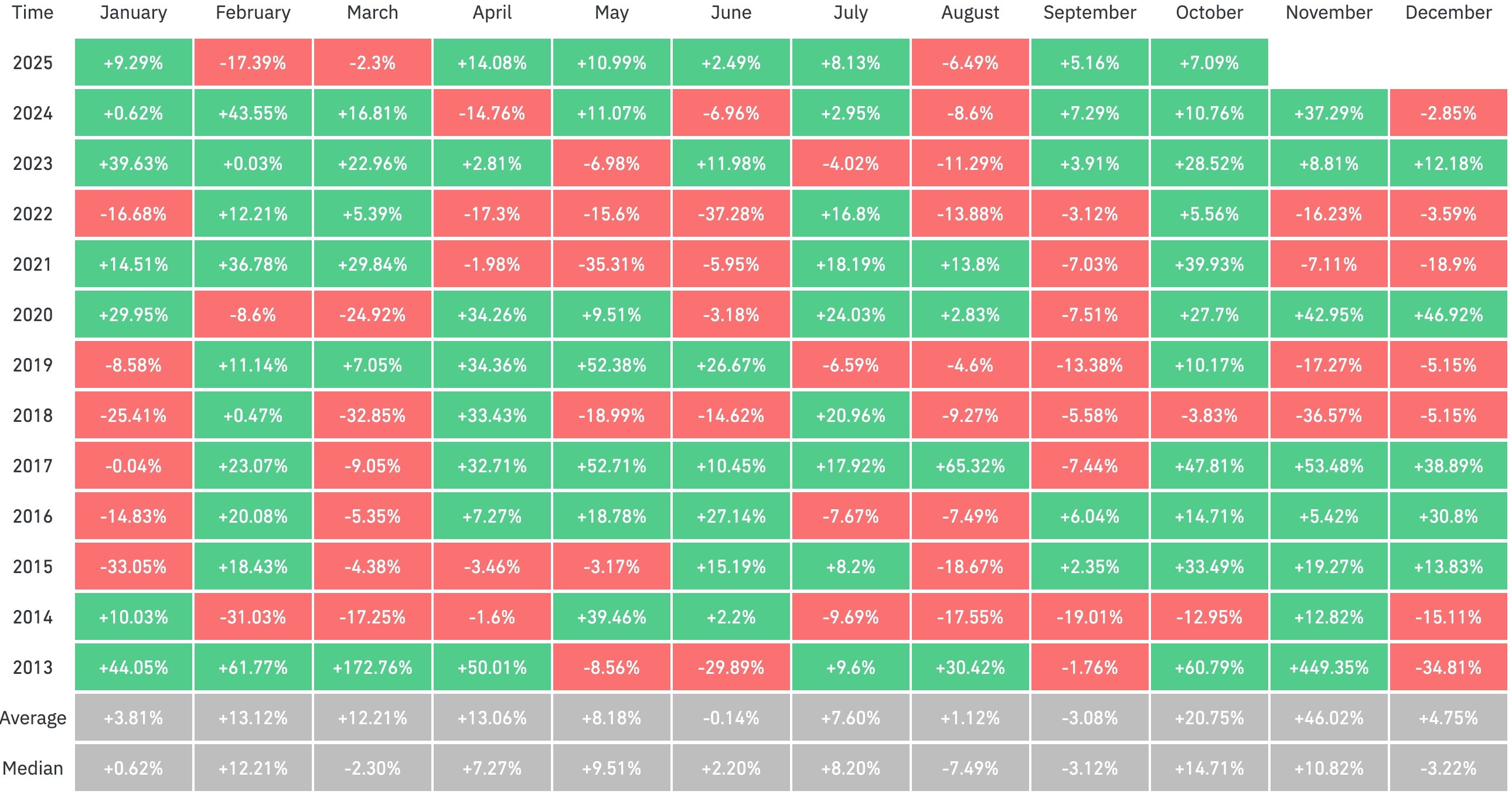

Data compiled by CoinGlass shows that the Bitcoin price normally jumps in October. It has had positive returns in October of all years since 2020. The average return in October since 2013 is 20%, making it the best month after November.

Also, the fourth quarter is usually the best period for the crypto industry in a year. Bitcoin’s average return is 80%, second only to Q1’s 51%.

Altcoin ETF approvals ahead

The other main reason why the crypto market is going up is the hope that the Securities and Exchange Commission will start approving crypto ETFs soon.

The agency has set October as the deadline for most altcoin ETFs, including popular names like Solana and XRP. These approvals will likely boost prices as Wall Street investors start buying as they have done with Ethereum and Bitcoin.