Blockchain analytics firm Arkham Intelligence says the United Arab Emirates has amassed approximately $700 million worth of Bitcoin through state-linked mining operations.

Summary

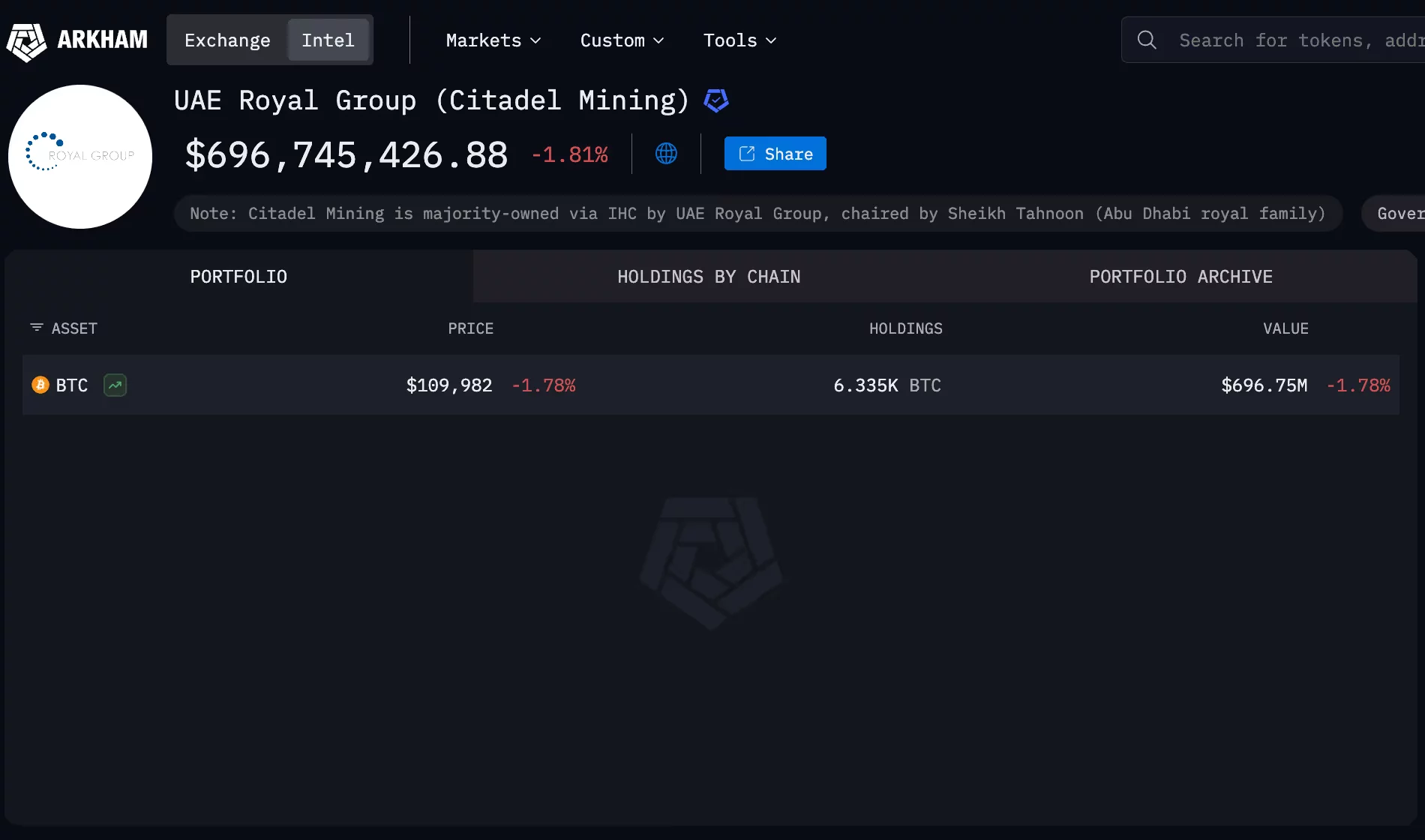

- Arkham Intelligence says UAE government-linked wallets contain roughly 6,300 BTC worth about $700 million.

- The holdings stem from industrial-scale mining via Citadel Mining, not seizures or open-market purchases.

- With an estimated 9,300 BTC mined in total, the UAE ranks near sixth globally among publicly identified government Bitcoin holders.

UAE amasses $700M BTC war chest via state-linked miner

According to Arkham’s on-chain research, wallets identified as controlled by the UAE government hold around 6,300 Bitcoin (BTC), valued near $700 million at current prices.

These holdings arise not from asset seizures or market purchases, but primarily from Bitcoin mined via Citadel Mining, a public mining company majority-owned by the UAE-backed conglomerate International Holding Company (IHC), itself linked to the UAE Royal Group.

Arkham notes that the UAE’s Bitcoin reserves make it one of the largest sovereign Bitcoin holders globally, potentially ranking near sixth among nations based on publicly identified holdings.

Unlike other governments whose Bitcoin treasuries stem largely from law enforcement seizures, such as the United States and United Kingdom, the UAE’s stash is a product of industrial-scale mining operations.

Arkham researchers say the UAE has mined roughly 9,300 BTC in total, of which approximately 6,300 BTC remain in government-linked wallets, with the rest either deployed or held in associated entities like Phoenix Group.

Satellite imagery corroborated with on-chain data shows Citadel’s mining facility in Abu Dhabi was built in 2022 in partnership with Phoenix Group. Arkham’s report suggests this approach aligns with broader diversification efforts by the oil-rich nation into digital finance and blockchain infrastructure.

While the value of the holdings will fluctuate with Bitcoin prices, the data highlights the UAE’s unique path into crypto: a production-based Bitcoin reserve rather than simple accumulation through market buys or seizures, spotlighting how sovereign actors are navigating and participating in the digital asset ecosystem.